Share to

Shanghai Shenkai Petroleum & Chemical Equipment Co., Ltd. (hereinafter referred to as Shenkai)’s 2025 private placement of A-shares to specific investors under simplified procedures was successfully listed on December 26, 2025, marking the successful completion of this capital-raising project. The placement raised a total of RMB 220 million, which will be used to support Shenkai’s strategic development in the fields of offshore oil and gas and AI-driven digital oilfield services.

| Efficient Project Execution and Strong Capital Market Recognition of Corporate Strategy

The private placement project formally entered internal review of the issuance plan in June 2025, and from capital subscription to listing and trading in December, the entire process took only six months, demonstrating Shenkai’s strong capabilities in capital operations and project execution. The placement ultimately attracted seven well-known institutional investors, including Caitong Fund Management, Luhua Daosheng Group, Yimi Fund, Lord Abbett China Asset Management, Huaan Asset Management, Donghai Funds, and Hunan Light Salt Venture Capital Management, underscoring broad-based investor consensus on Shenkai’s long-term investment value.

| Focusing on Offshore Oil and Gas Equipment, Deepening “AI + Oil & Gas” Integration, and Injecting New Momentum for Sustainable Development

The proceeds from this private placement will be invested in high-end offshore oil and gas equipment and AI-powered digital oilfield services:

First, Shenkai will further enhance its R&D and manufacturing capabilities in deepwater oil and gas equipment, actively responding to the national strategy for domestic substitution. Key development areas include unmanned and intelligent integrated wellhead equipment and control systems, as well as fast logging equipment suitable for deepwater exploration. These efforts will continuously improve product innovation and manufacturing technologies, providing robust equipment support for overcoming international technical barriers and ensuring the independent development of China’s deepwater resources.

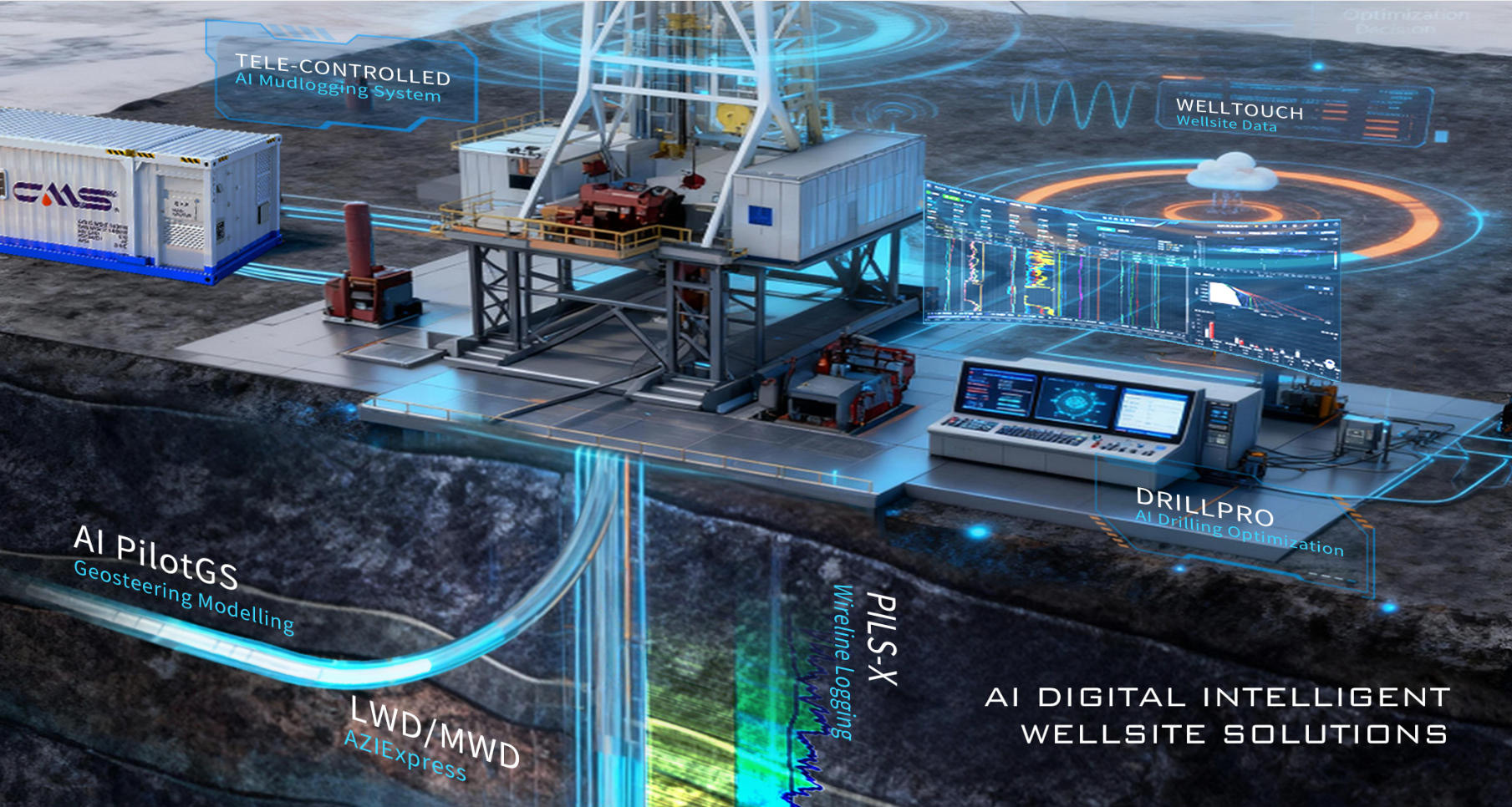

Second, through the strategic acquisition of BOET, Shenkai will leverage its technological strengths and resource advantages in AI-driven digital solutions for the oil and gas industry. By deeply integrating these capabilities with Shenkai’s existing survey, measurement, logging, and guidance systems, Shenkai aims to build digital intelligent wellsite solutions centered on “Survey–Measurement–Logging–Guidance–Drilling + AI Core.” This will establish a complete closed loop of “hardware equipment + AI-assisted decision-making + engineering services,” driving Shenkai’s business model transformation from an “oilfield equipment supplier” to a “comprehensive digital intelligent wellsite solutions provider,” and securing a first-mover advantage in the industry’s digital and intelligent transformation.

While delivering solid returns for all investors, the private placement investment projects also serve as a key foundation for Shenkai’s future industrial upgrading. They align with the national priorities of the 15th Five-Year Plan and will further consolidate and enhance Shenkai’s core competitiveness in the fields of energy equipment and engineering services.

| Significant Performance Growth and Strong Market Investment Enthusiasm

In recent years, Shenkai’s fundamentals have continued to improve. During the first three quarters of this year, operating revenue increased by 15% year-on-year, while net profit attributable to shareholders surged by 86% year-on-year. Benefiting from solid performance growth and the steady advancement of strategic planning, Shenkai’s long-term investment value has been highly recognized by the capital market, with its share price recording a cumulative increase of over 130% within the year. The effective subscription amount for this private placement reached three times the fundraising cap, fully reflecting strong market confidence in Shenkai’s development prospects.

The successful issuance of this private placement has significantly strengthened Shenkai’s capital base, optimized its asset-liability structure, and enhanced its risk resilience, providing solid financial support for optimizing industrial layout and implementing long-term development strategies.

Hereby, Shenkai extends its sincere gratitude to all shareholders for their steadfast recognition and long-term support, and expresses heartfelt thanks to the professional partners who contributed to this private placement: the sponsor and lead underwriter—AJ Securities Co., Ltd., legal counsel—JunHe LLP, auditing firm—Zhonghui Certified Public Accountants, and consulting firm—Tashan Consulting Co., Ltd.

Looking ahead, Shenkai will continue to actively respond to national strategies for fostering innovation in future industries, fully embrace artificial intelligence, and focus on deep-earth and deep-sea domains. Shenkai is committed to becoming a core enterprise in deep-resource exploration and development, fulfilling the mission of energy self-reliance and equipment strength, and contributing Shenkai’s capabilities to advancing China’s energy security, low-carbon transition, and other major national strategies.